Home / News & Events / Articles, White Papers & Case Studies / KYC and Why It Matters...

Most marketing efforts and customer-facing businesses study and survey consumers to understand their target demographic, learn about their buying habits, and hopefully offer programs that attract new customers and retain existing ones. So, although this KYC (Know Your Customer) concept has been around awhile and in fact has been baked into our business assurance solutions for years, it has taken on new life in the telecommunications industry lately thanks to FCC mandates aimed at eliminating unlawful robocalls. This article examines that trend as well as the role and importance of KYC in protecting and optimizing your revenue.

There is not a singular standard KYC (Know Your Customer) method for the telecom industry. But long before it had a well-known acronym, the Protector and TeleLink business assurance solutions included a plethora of tools that fulfilled that very purpose. At its core, KYC is the protective, proactive measure of using key data points and/or actions to assess a customer’s legitimacy and the potential risks of doing business with that entity. Currently, service providers are typically interested in examining many of the same data points and have similar goals for what to do with that information; however, the process for doing so varies from organization to organization. Of course, the most compelling application for it these days is addressing robocalling as a result of FCC mandates.

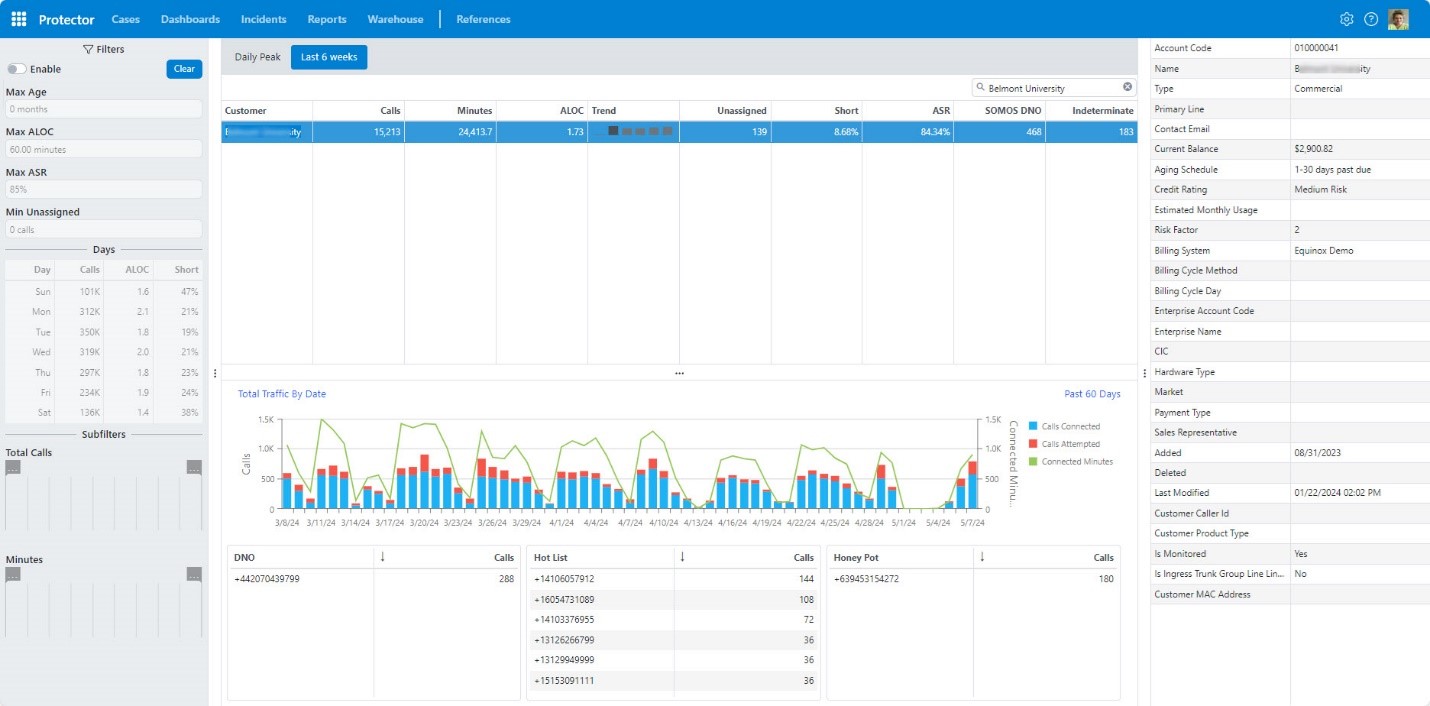

KYC is an essential resource for making sure your customers aren’t illegally robocalling and legitimate autodial traffic isn’t labeled as spam; KYC is essential to efforts to restore trust in the telecommunications industry. Most commonly, KYC combines a customer’s profile, including account age, credit, usage patterns that include ALOC, ASR, % short calls, and compares individual calling and called numbers to known hot lists, honeypot numbers, or from numbers marked as DNO (do not originate) list. This analysis gives carriers a more complete picture and forms the basis for informed and sound decisions because it relies on more than account history or disparate facts.

Adopting and enforcing a defined KYC (Know Your Customer) policy is not only required for legal compliance, but it’s also beneficial for telecom service providers for many reasons.

KYC initiatives provide the data you need to spot bad actors, imposters, banned enterprises shopping for a new “home,” and even carriers that don’t properly vet their customers. Of course, it’s a valuable resource for legal compliance and continuing to support your legitimate, valued customers.

While the FCC mandates require “effective measures,” they offer no proscriptive KYC policy. As such, it takes on many forms and looks different at each organization. It may contain the RealNumber DNO list (maintained by Somos, the trusted global provider of telephone number and identity information services), other authoritative phone number data sets, internal lists/processes such as hot list or honeypots, STIR/SHAKEN certificate management, and any host of distinct, meaningful statistics. As for comprehensive KYC best practices, we recommend evaluating three key areas: aggregated usage, calls leaving your network, and calls entering your network. Your KYC analysis should seek to determine if the customer/ carrier:

If you’ve got the Protector or TeleLink applications and/or worked with Christi Vanoye, you should be familiar with the previous list. The rules, reports, alerts, and analytics in those applications are specifically designed to help answer those questions—in fact allowing you to know your customer. In an effort to provide even more valuable tools in the Protector and TeleLink systems, Equinox created a new KYC dashboard to bring all this information into a single, filterable presentation. As part of this initiative, we partnered with Somos to incorporate their RealNumber DNO data in the dashboard. The graphic following this paragraph depicts the type of information currently available on the KYC dashboard in Protector and gives you an idea of what’s possible in this realm.

Our mission is to help telecom companies and service providers protect and optimize revenue. Helping you succeed in those areas is vital to our very existence. So, we’re more than solutions suppliers; we are your partner. Our training, implementation, and support teams provide one-on-one, personalized assistance to maximize the benefit from every tool and feature we offer. If KYC is a new concept or you’d like to explore best practice recommendations, we can help.